Budgeting Made Simple: 10 Tips to Save Money!

In today’s fast-paced world, managing your finances can be a daunting task. With bills to pay, groceries to buy, and unexpected expenses popping up left and right, it’s easy to feel overwhelmed. However, with the right budgeting strategies in place, you can take control of your finances and start saving money for the future. Here are 10 easy tips to help you successfully budget your money:

1. Set Financial Goals: Before you can start budgeting effectively, you need to determine what your financial goals are. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having clear goals in mind will help you stay motivated and focused on your budgeting journey.

2. Track Your Expenses: The first step to successful budgeting is knowing where your money is going. Keep track of all your expenses, from your morning coffee to your monthly bills, to get a clear picture of your spending habits. You can use apps or spreadsheets to make this process easier.

3. Create a Budget: Once you have a good understanding of your expenses, it’s time to create a budget. Start by listing your monthly income and fixed expenses, such as rent and utilities. Then allocate a portion of your income to savings, debt repayment, and discretionary spending.

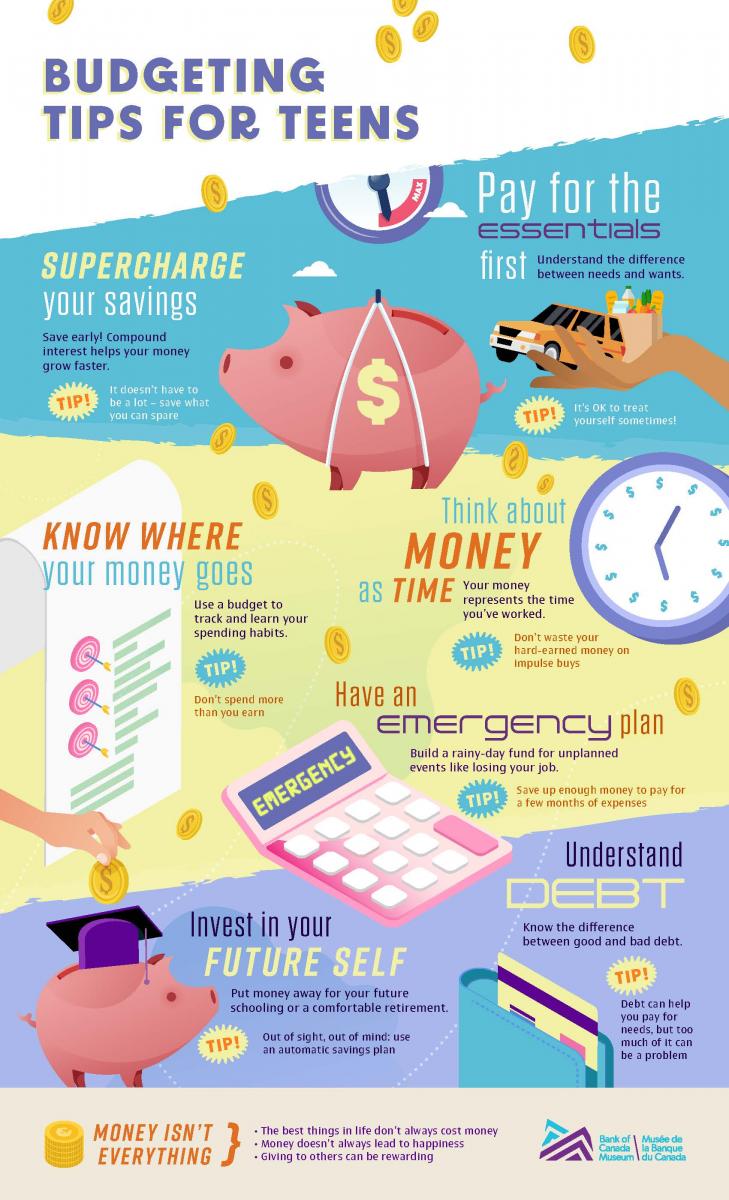

Image Source: bankofcanadamuseum.ca

4. Cut Unnecessary Expenses: Take a close look at your expenses and identify areas where you can cut back. Do you really need that daily latte or expensive gym membership? By eliminating unnecessary expenses, you can free up more money to put towards your financial goals.

5. Use Cash Envelopes: One effective budgeting strategy is to use cash envelopes for certain categories of spending, such as groceries or entertainment. By physically separating your money, you can better control your spending and avoid going over budget.

6. Automate Your Savings: Make saving money a priority by setting up automatic transfers to your savings account. This way, you can save money before you have a chance to spend it, helping you reach your financial goals faster.

7. Shop Smart: When it comes to shopping, be a savvy consumer. Look for sales, use coupons, and compare prices before making a purchase. By being mindful of your spending, you can stretch your budget further and save money in the long run.

8. Plan Your Meals: Eating out can quickly eat into your budget, so consider meal planning as a way to save money. By preparing meals at home and bringing your lunch to work, you can cut down on food expenses and reduce unnecessary spending.

9. Review Your Budget Regularly: Budgeting is an ongoing process, so make sure to review your budget regularly and make adjustments as needed. Life changes, and so should your budget. By staying proactive and flexible, you can ensure that your budget remains effective.

10. Celebrate Your Successes: Finally, don’t forget to celebrate your budgeting successes along the way. Whether you reach a savings goal or pay off a credit card, take the time to acknowledge your achievements and stay motivated to continue on your financial journey.

Budgeting doesn’t have to be complicated or stressful. By implementing these 10 tips, you can easily save money, reach your financial goals, and achieve financial freedom. So why wait? Start budgeting today and take control of your finances!

Financial Freedom Awaits: Easy Budgeting Strategies

Budgeting is a crucial aspect of managing your finances and achieving financial freedom. It allows you to track your expenses, prioritize your spending, and save for the future. However, many people find budgeting to be a daunting task. The good news is that with the right strategies, budgeting can be easy and even enjoyable. Here are 10 easy tips to help you successfully budget and work towards financial freedom.

1. Set Clear Goals:

Before you start budgeting, it’s important to have a clear understanding of your financial goals. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having specific goals in mind will help you stay motivated and focused on your budgeting journey.

2. Track Your Expenses:

One of the most effective ways to create a successful budget is to track your expenses. Keep a record of everything you spend money on, from groceries to coffee to bills. This will give you a clear picture of where your money is going and help you identify areas where you can cut back.

3. Create a Budget:

Once you have a good grasp of your expenses, it’s time to create a budget. Start by listing your income and fixed expenses, such as rent and utilities. Then allocate a portion of your income to savings and discretionary spending. Make sure to adjust your budget as needed to stay on track.

4. Use a Budgeting Tool:

There are plenty of budgeting tools and apps available that can help simplify the budgeting process. These tools can automatically categorize your expenses, track your spending, and even send you reminders when you’re nearing your budget limits.

5. Cut Unnecessary Expenses:

Take a close look at your expenses and identify any unnecessary or frivolous spending. Cutting back on these expenses can free up more money to put towards your financial goals. Whether it’s eating out less or canceling subscriptions you don’t use, every little bit counts.

6. Automate Your Savings:

Make saving a priority by automating your savings. Set up automatic transfers from your checking account to your savings account each month. This way, you won’t even have to think about it, and your savings will grow effortlessly over time.

7. Plan for Unexpected Expenses:

It’s important to budget for unexpected expenses, such as car repairs or medical bills. Create an emergency fund to cover these unforeseen costs so that you don’t have to dip into your savings or rely on credit cards.

8. Review and Adjust Regularly:

Budgeting is not a one-time task – it’s an ongoing process. Regularly review your budget to ensure you’re staying on track with your financial goals. Make adjustments as needed to accommodate any changes in your income or expenses.

9. Celebrate Your Successes:

Budgeting can be challenging, but it’s important to celebrate your successes along the way. Whether you reach a savings milestone or stick to your budget for a month, take the time to pat yourself on the back and acknowledge your hard work.

10. Stay Positive and Flexible:

Lastly, remember to stay positive and flexible throughout your budgeting journey. There may be setbacks or unexpected expenses, but it’s important to stay focused on your goals and adjust your budget accordingly. With a positive attitude and a willingness to adapt, you’ll be well on your way to achieving financial freedom.

Top 10 Tips for Effective Budgeting