Weathering the Storm: Smart Money Tips for Recession

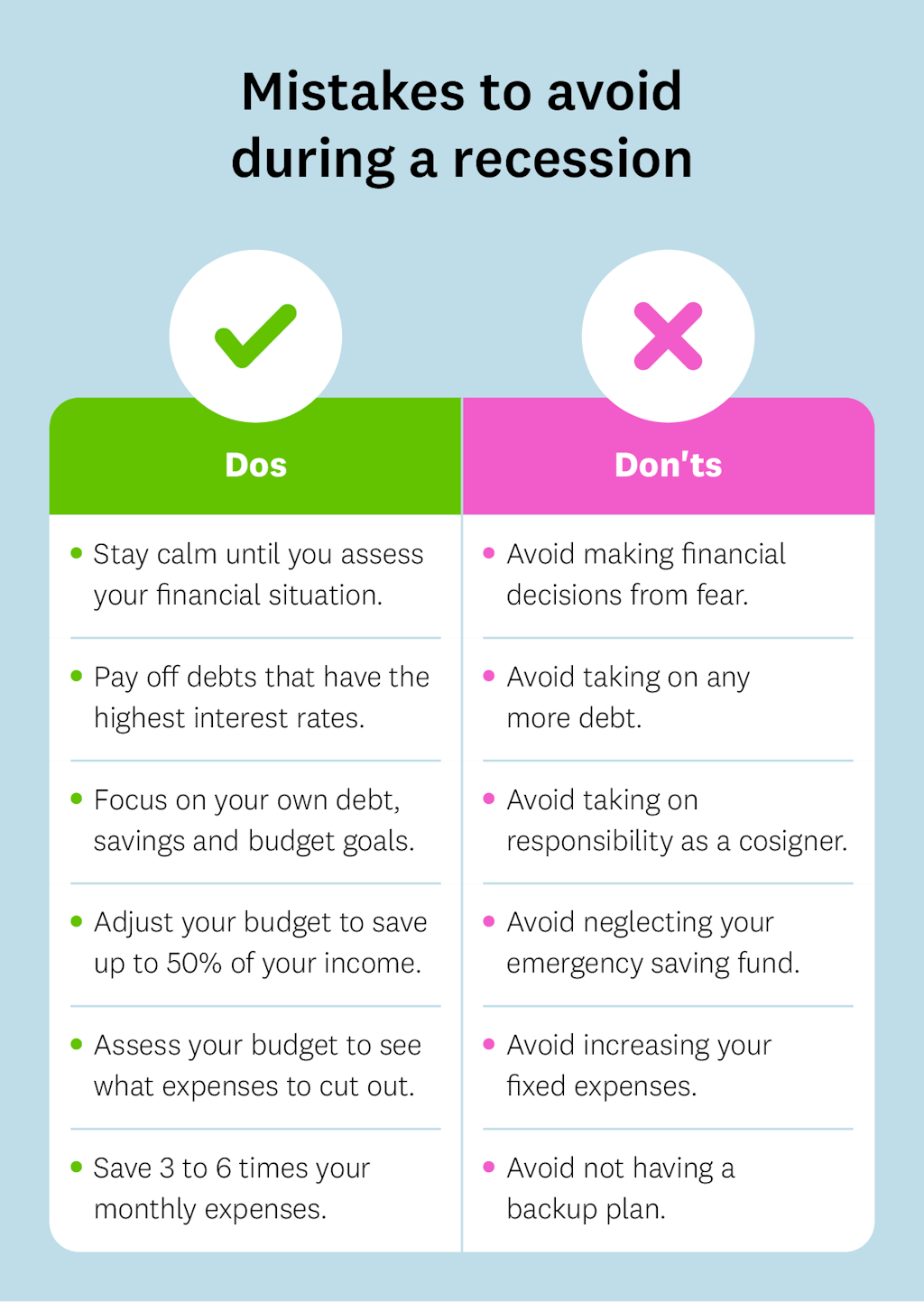

In times of economic uncertainty, it’s important to be prepared and have a plan in place to weather the storm. A recession can bring about financial challenges that may seem daunting, but with the right mindset and smart money moves, you can navigate through it with ease. Here are some tips to help you stay afloat during tough times:

1. Build an Emergency Fund: One of the most important things you can do to prepare for a recession is to have an emergency fund in place. This fund should cover at least three to six months’ worth of living expenses, including rent or mortgage payments, utilities, groceries, and other essentials. Having this cushion will give you peace of mind knowing that you have some financial security in case of job loss or unexpected expenses.

2. Cut Back on Non-Essential Spending: During a recession, it’s important to prioritize your spending and focus on the essentials. Take a close look at your budget and identify areas where you can cut back, such as dining out, shopping for unnecessary items, or expensive entertainment. By trimming your expenses, you can free up more money to put towards your emergency fund or savings.

3. Increase Your Income: In addition to cutting back on expenses, consider ways to increase your income during a recession. This could mean taking on a part-time job, freelancing, or selling items you no longer need. By finding creative ways to bring in extra cash, you can offset any financial setbacks and strengthen your financial position.

Image Source: imgix.net

4. Diversify Your Income Streams: Relying solely on one source of income can leave you vulnerable during a recession. To protect yourself against unexpected job loss or income reduction, consider diversifying your income streams. This could involve investing in stocks, real estate, or starting a side hustle. By having multiple sources of income, you can better withstand financial challenges and maintain your financial stability.

5. Prioritize Debt Repayment: During a recession, it’s important to prioritize debt repayment to avoid falling into a cycle of high-interest debt. Focus on paying off high-interest debts first, such as credit card debt or personal loans, before tackling lower-interest debts like student loans or mortgages. By reducing your debt load, you can free up more money for savings and build a stronger financial foundation.

6. Stay Informed and Flexible: In times of economic uncertainty, it’s important to stay informed about the current economic landscape and be flexible with your financial decisions. Keep an eye on market trends, interest rates, and job opportunities, and be prepared to adjust your financial strategy as needed. By staying proactive and adaptable, you can navigate through a recession with confidence and ease.

7. Seek Professional Advice: If you’re feeling overwhelmed or unsure about your financial situation during a recession, don’t hesitate to seek professional advice. A financial planner or advisor can help you create a customized financial plan, identify areas for improvement, and provide guidance on how to achieve your financial goals. By working with a professional, you can gain valuable insights and peace of mind knowing that you’re on the right track towards financial success.

By following these smart money tips for recession, you can weather the storm and come out stronger on the other side. With careful planning, discipline, and a positive attitude, you can navigate through financial challenges with ease and secure your financial future. Remember, a recession may bring about challenges, but with the right mindset and smart money moves, you can overcome them and thrive in any economic environment.

Ride the Wave: Navigating Financial Challenges with Ease

In times of economic uncertainty, it can be easy to feel overwhelmed and anxious about your financial situation. However, with the right mindset and strategies in place, you can navigate these challenges with ease and come out on top. Here are some smart money moves to help you ride the wave during a recession.

First and foremost, it’s important to stay calm and avoid making impulsive decisions when it comes to your finances. It can be tempting to panic and withdraw all of your investments or make drastic changes to your budget, but this can actually do more harm than good in the long run. Instead, take a deep breath and assess your financial situation rationally.

One of the best ways to navigate financial challenges during a recession is to focus on increasing your income streams. This could mean taking on a side hustle, freelancing, or looking for new job opportunities. By diversifying your sources of income, you can better protect yourself against economic downturns and ensure that you have a steady cash flow.

Additionally, it’s important to review your budget and cut back on unnecessary expenses. Look for areas where you can save money, such as dining out less frequently, canceling subscription services you don’t use, or negotiating lower bills with your service providers. By tightening up your budget, you can free up extra cash to put towards savings or paying off debt.

Speaking of savings, having an emergency fund in place is crucial during uncertain times. Aim to have at least three to six months’ worth of living expenses saved up in case of a financial emergency. This can provide you with a safety net and peace of mind knowing that you have a buffer to fall back on if needed.

Another smart money move during a recession is to focus on paying down high-interest debt. By tackling your debt aggressively, you can save money on interest payments and improve your overall financial health. Consider prioritizing your debts based on interest rates and working towards paying off the highest interest debt first.

Investing wisely is also key to navigating financial challenges with ease. While it can be tempting to pull out of the stock market during a recession, it’s important to remember that timing the market is nearly impossible. Instead of trying to predict market fluctuations, focus on long-term investing strategies and diversifying your portfolio to reduce risk.

In addition to traditional investments, consider alternative ways to grow your money during a recession. This could include investing in real estate, peer-to-peer lending, or starting a small business. By exploring different investment opportunities, you can potentially increase your income and build wealth over time.

Lastly, don’t forget to take care of your mental and physical well-being during challenging times. Stress and anxiety about finances can take a toll on your health, so make sure to prioritize self-care activities such as exercise, meditation, and spending time with loved ones. Remember that your financial situation does not define your worth, and that there are always options and resources available to help you navigate through tough times.

By following these smart money moves and maintaining a positive outlook, you can ride the wave of financial challenges with ease and come out stronger on the other side. Remember, recessions are a natural part of the economic cycle, and with careful planning and strategic decisions, you can weather the storm and emerge more resilient than ever.

Tips for Financially Surviving a Recession