Finding Your Financial Happy Place

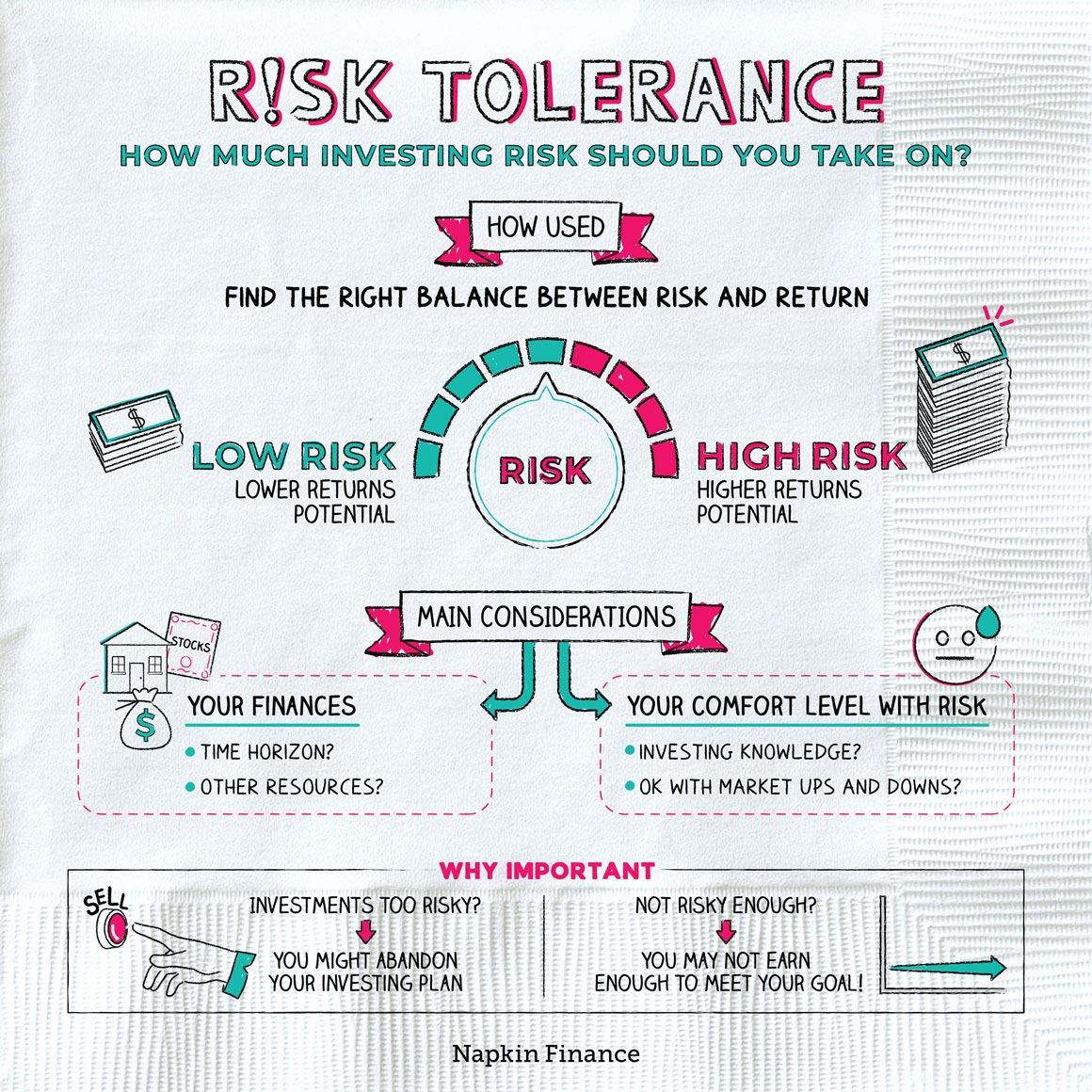

When it comes to investing, one of the most important factors to consider is your risk comfort zone. This is essentially the level of risk you are willing to take with your investments, based on your financial goals, personality, and tolerance for volatility in the market. Finding your financial happy place means striking the right balance between risk and return, so that you can achieve your goals without losing sleep over market fluctuations.

To determine your risk comfort zone in investing, start by taking a close look at your financial goals. Are you saving for retirement, a down payment on a house, or your children’s education? Do you have a timeline for reaching these goals, or are they more long-term in nature? Understanding your goals will help you assess how much risk you can afford to take with your investments.

Next, consider your personality and attitude towards risk. Are you someone who is comfortable with uncertainty and willing to take chances in pursuit of higher returns? Or do you prefer to play it safe and prioritize capital preservation over growth? Knowing yourself and your risk tolerance is crucial in finding your financial happy place.

It’s also important to factor in your financial situation when determining your risk comfort zone. Take into account your income, savings, and overall financial stability. If you have a steady income and a healthy emergency fund, you may be more willing to take on greater risk in your investments. On the other hand, if you have limited savings and a high level of debt, you may need to be more cautious in your approach to investing.

Image Source: napkinfinance.com

Once you have a clear understanding of your financial goals, risk tolerance, and overall financial situation, you can begin to construct a diversified investment portfolio that aligns with your risk comfort zone. Diversification is key to managing risk in investing, as it helps spread your investments across different asset classes, industries, and geographic regions. This can help reduce the impact of market volatility on your portfolio and improve your chances of achieving your financial goals.

In addition to diversification, it’s important to periodically review and adjust your investment strategy to ensure that it continues to align with your risk comfort zone. Market conditions and your personal circumstances can change over time, so it’s important to regularly reassess your investments and make any necessary adjustments to stay on track towards your financial goals.

Ultimately, finding your financial happy place in investing is about striking a balance between risk and return that allows you to achieve your goals while staying true to your personality and financial situation. By taking the time to understand your risk comfort zone and construct a well-diversified investment portfolio, you can navigate the ups and downs of the market with confidence and peace of mind. So embrace risk with a smile, and remember that finding your financial happy place is a journey, not a destination.

Embracing Risk with a Smile

Investing can be a daunting task, especially when it comes to the concept of risk. Many people tend to shy away from risk, opting for safer investments that may not yield as high of a return. However, embracing risk with a smile can actually be a beneficial mindset to have when it comes to investing.

Determining your risk comfort zone in investing is crucial in order to create a balanced and successful investment portfolio. Risk tolerance varies from person to person, and it is important to understand where you fall on the risk spectrum in order to make informed investment decisions.

One way to embrace risk with a smile is to think of it as an opportunity for growth and potential financial gain. While there is always a chance of losing money when investing in riskier assets, there is also the potential for higher returns. By taking on a bit more risk, you are opening yourself up to the possibility of greater rewards.

It is also important to consider your investment goals when determining your risk comfort zone. If you are investing for long-term growth and have a higher risk tolerance, you may be more willing to take on riskier investments in order to potentially achieve higher returns. On the other hand, if you are investing for short-term gains or to preserve capital, you may want to stick to safer investments with lower risk.

Another way to embrace risk with a smile is to diversify your investment portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can help mitigate risk and potentially increase your chances of achieving a positive return. Diversification is a key strategy in managing risk and can help you weather market volatility with a smile on your face.

It is also important to regularly review and adjust your investment portfolio to ensure that it aligns with your risk comfort zone and investment goals. As your financial situation and goals change, so too may your risk tolerance. By staying proactive and making adjustments as needed, you can ensure that your investment portfolio remains in line with your risk comfort zone.

Ultimately, embracing risk with a smile is about having a positive attitude towards the ups and downs of investing. While there is always a level of uncertainty and risk involved in investing, approaching it with a smile can help you navigate the challenges and setbacks with a sense of optimism and resilience. By determining your risk comfort zone, diversifying your portfolio, and staying proactive in your investment strategy, you can embrace risk with a smile and work towards achieving your financial goals.

Understanding Risk Tolerance in Investing