Spice Up Your Finances!

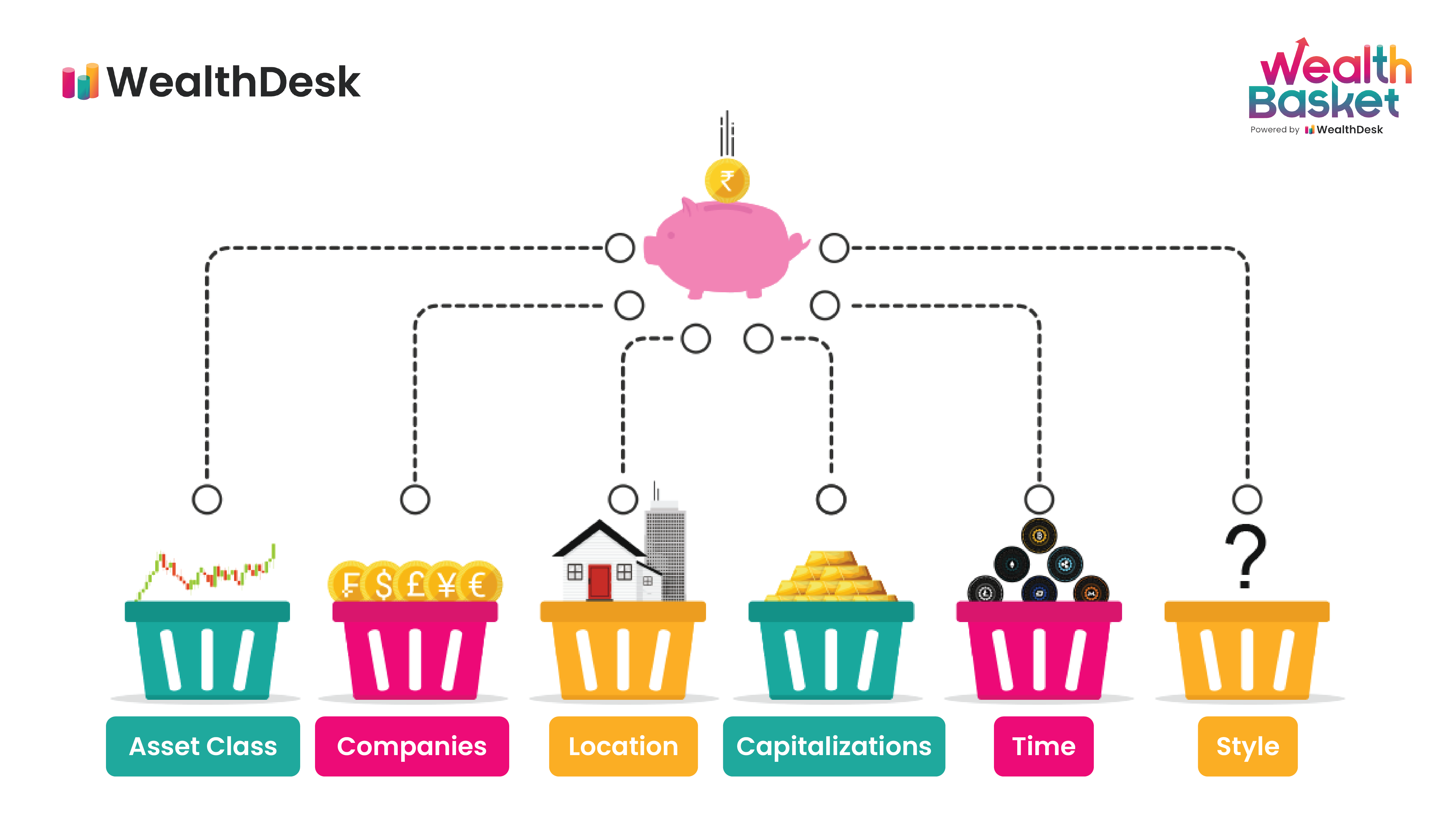

Are you looking to spice up your investment portfolio and add a little flavor to your finances? Diversifying your investments is a great way to do just that! By spreading your money across different types of assets, you can reduce your risk and potentially increase your returns. Here are some simple steps to help you diversify your investment portfolio and make your money work harder for you.

First, take a look at your current investments and assess how diversified they are. Do you have all of your money in one type of asset, such as stocks or real estate? If so, it’s time to mix things up! Consider adding different types of investments to your portfolio, such as bonds, mutual funds, or even alternative assets like gold or cryptocurrency.

Next, think about your investment goals and risk tolerance. Are you looking for long-term growth, or are you more interested in preserving your capital? Your goals and risk tolerance will help you determine the best mix of investments for your portfolio. For example, if you are a conservative investor, you may want to focus on low-risk assets like bonds. On the other hand, if you are willing to take on more risk for the potential of higher returns, you may want to consider investing in stocks or other higher-risk assets.

Another way to spice up your finances is to consider investing in different sectors of the economy. By diversifying across sectors, you can reduce your exposure to any one industry or market downturn. For example, if you have a lot of money invested in tech stocks, consider adding some investments in healthcare or consumer goods to balance out your portfolio.

Image Source: wealthdesk.in

Furthermore, don’t forget to consider geographic diversification. Investing in different countries and regions can help protect your portfolio from the risks of a specific economy or political situation. Look for opportunities to invest in international markets or consider adding emerging market funds to your portfolio for added diversity.

In addition to diversifying across different types of assets, sectors, and regions, consider adding some alternative investments to your portfolio. Alternative assets, such as real estate, commodities, or private equity, can provide additional diversification and potentially higher returns. Just be sure to do your research and understand the risks associated with these types of investments.

Finally, regularly review and rebalance your portfolio to ensure that it remains diversified and aligned with your investment goals. As markets change and evolve, your portfolio may need adjustments to stay on track. Consider working with a financial advisor to help you make informed decisions and stay on top of your investments.

By following these simple steps to diversify your investment portfolio, you can spice up your finances and make your money work harder for you. So, get creative, think outside the box, and start diversifying today! Your future self will thank you for it.

Make Your Money Work Harder!

Are you looking to take your finances to the next level and make your money work harder for you? Diversifying your investment portfolio is a great way to do just that. By spreading your investments across different asset classes, you can reduce risk and potentially increase returns.

One simple step to diversify your investment portfolio is to consider investing in real estate. Real estate can provide a steady stream of rental income and potential for appreciation in value over time. Whether you choose to invest in residential properties, commercial real estate, or real estate investment trusts (REITs), adding real estate to your portfolio can help you achieve greater diversification.

Another way to make your money work harder is to invest in stocks and bonds. Stocks offer the potential for high returns, but also come with higher risk. Bonds, on the other hand, provide a more stable source of income with lower risk. By investing in a mix of stocks and bonds, you can balance risk and reward in your portfolio.

If you’re looking for even more ways to diversify your investment portfolio, consider alternative investments such as commodities, precious metals, or cryptocurrencies. These assets can provide a hedge against inflation and market volatility, adding another layer of diversification to your portfolio.

In addition to diversifying across different asset classes, it’s also important to diversify within each asset class. For example, if you’re investing in stocks, consider spreading your investments across different industries and geographic regions. This can help protect your portfolio from sector-specific risks and market downturns.

One final step to make your money work harder is to regularly review and rebalance your investment portfolio. Over time, the performance of different assets in your portfolio may vary, causing your asset allocation to drift from your original targets. By periodically rebalancing your portfolio, you can ensure that your investments are aligned with your financial goals and risk tolerance.

In conclusion, diversifying your investment portfolio is a simple yet effective way to make your money work harder for you. By spreading your investments across different asset classes and within each asset class, you can reduce risk and potentially increase returns. Consider adding real estate, stocks, bonds, and alternative investments to your portfolio, and regularly review and rebalance your investments to stay on track towards your financial goals. With these simple steps, you can take your finances to the next level and achieve greater financial success.

How to Diversify Your Investment Portfolio