Dive into Casual Investments

Welcome to the exciting world of casual investments! If you’re a beginner looking to dip your toes into the world of investing, you’ve come to the right place. In this beginner’s guide, we’ll break down everything you need to know about casual investments and how you can get started on your investment journey.

Casual investments are a great way for beginners to start building their investment portfolio without diving headfirst into the complexities of the stock market. Unlike traditional investments that require a significant amount of capital and expertise, casual investments are low-risk and easy to manage, making them perfect for those who are just starting out.

One of the most popular forms of casual investments is investing in index funds. Index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500. By investing in an index fund, you can gain exposure to a diversified portfolio of stocks without having to pick individual stocks yourself. This makes index funds a great option for beginners who want to start investing without the stress of picking stocks.

Another popular form of casual investment is investing in exchange-traded funds (ETFs). ETFs are similar to index funds in that they track a specific index, but they are traded on a stock exchange just like individual stocks. This makes ETFs a flexible and convenient option for casual investors who want to buy and sell their investments easily.

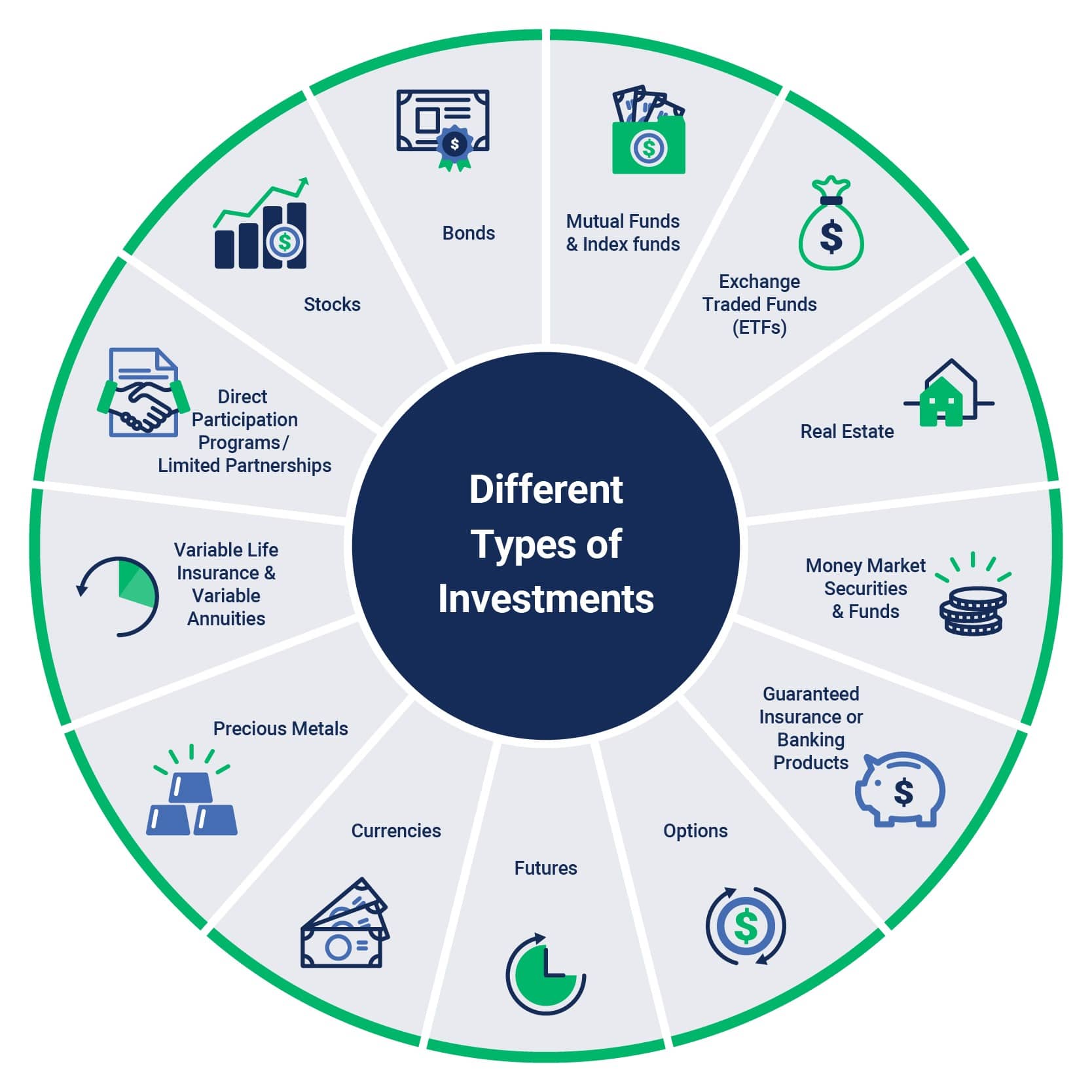

Image Source: mcfieinsurance.com

In addition to index funds and ETFs, casual investors can also consider investing in bonds. Bonds are a form of fixed-income investment that pay a predetermined interest rate over a set period of time. While bonds may not offer the same potential for high returns as stocks, they are generally considered to be a safer investment option, making them a great choice for conservative investors.

When diving into casual investments, it’s important to do your research and understand the risks involved. While casual investments are generally low-risk, it’s still possible to lose money, especially in volatile markets. By staying informed and making informed decisions, you can minimize your risks and maximize your potential returns.

One of the key benefits of casual investments is their accessibility. Unlike traditional investments that require a large amount of capital to get started, casual investments can be made with as little as a few hundred dollars. This makes casual investments a great option for beginners who may not have a lot of money to invest but still want to start building their wealth.

In addition to being accessible, casual investments are also easy to manage. With the rise of online investment platforms and robo-advisors, it’s never been easier to buy and sell investments from the comfort of your own home. These platforms often offer low fees and user-friendly interfaces, making it simple for beginners to start investing with confidence.

As a beginner, it’s important to start small and gradually build your investment portfolio over time. By diversifying your investments across different asset classes, you can reduce your overall risk and increase your chances of earning a solid return. Remember, investing is a long-term game, so be patient and stick to your investment strategy even when the market gets rocky.

In conclusion, casual investments are a great way for beginners to start building their investment portfolio without the stress and complexity of traditional investments. By investing in index funds, ETFs, bonds, and other low-risk assets, you can start growing your wealth and achieving your financial goals. So what are you waiting for? Dive into casual investments today and start your investment journey with confidence!

Easy Steps for Beginners

Welcome to the world of casual investments! If you’re just starting out on your investment journey, it’s important to take things slow and steady. With the right approach, you can begin building a financial portfolio that will grow over time. In this article, we’ll break down some easy steps for beginners to get started in the world of casual investments.

1. Do Your Research

The first step in any investment journey is to do your research. Take the time to educate yourself on the different types of investments available, such as stocks, bonds, mutual funds, and real estate. Consider your financial goals and risk tolerance to determine which investment options are best for you.

There are plenty of resources available to help you learn about investing, from books and online articles to financial advisors and investment seminars. Take advantage of these resources to build a solid foundation of knowledge before you start investing your hard-earned money.

2. Set Clear Goals

Before you make any investments, it’s important to set clear financial goals for yourself. Do you want to save for retirement, buy a house, or go on a dream vacation? By setting specific goals, you can tailor your investment strategy to meet your individual needs.

Consider how much money you can afford to invest and how long you plan to hold onto your investments. Having clear goals in mind will help you stay focused and motivated as you navigate the world of casual investments.

3. Start Small

As a beginner investor, it’s a good idea to start small with your investments. Consider opening a brokerage account with a reputable online platform that offers low fees and easy-to-use tools. You can begin by investing in index funds or exchange-traded funds (ETFs), which offer a diversified portfolio with minimal risk.

By starting small, you can gain valuable experience in the world of investing without putting too much of your money at risk. As you become more comfortable with the process, you can gradually increase the size of your investments.

4. Diversify Your Portfolio

One of the key principles of successful investing is diversification. By spreading your investments across different asset classes, industries, and regions, you can reduce the risk of losing money if one of your investments performs poorly.

Consider investing in a mix of stocks, bonds, real estate, and other assets to create a well-rounded portfolio. Diversification can help you weather market fluctuations and achieve more stable returns over time.

5. Stay Informed

The world of investments is constantly changing, so it’s important to stay informed about market trends, economic news, and new investment opportunities. Take the time to read financial news, follow market analysts, and attend investment seminars to keep up-to-date on the latest developments.

By staying informed, you can make informed decisions about your investments and adjust your strategy as needed. Remember that investing is a long-term process, and it’s important to stay patient and disciplined as you work towards your financial goals.

In conclusion, getting started in the world of casual investments is an exciting journey that can help you build wealth and achieve your financial dreams. By following these easy steps for beginners, you can lay the foundation for a successful investment portfolio that will grow over time. Happy investing!

Understanding Different Types of Investments