Steer Clear of Money Mishaps

Navigating Common Financial Pitfalls: A Casual Guide

Money mishaps can happen to anyone, whether you’re a seasoned investor or just starting to dip your toes into the world of finance. It’s easy to get swept up in the excitement of making money, but it’s important to remember that one wrong move can send you tumbling down a slippery slope of financial woes. In this casual guide, we’ll explore some common money mishaps and how you can steer clear of them to keep your finances on track.

One of the most common money mishaps is overspending. It’s all too easy to get caught up in the allure of flashy new gadgets, trendy clothes, or fancy dinners out. Before you know it, you’ve blown through your budget and are left wondering where all your money went. To avoid this pitfall, it’s important to set a budget and stick to it. Keep track of your expenses, prioritize your needs over your wants, and think twice before making impulse purchases.

Another common money mishap is not saving for the future. It’s easy to put off saving for retirement or emergencies when you’re young and carefree, but the truth is, the earlier you start saving, the better off you’ll be in the long run. Make saving a priority by setting up automatic transfers to your savings account, contributing to a retirement fund, and building an emergency fund to cover unexpected expenses.

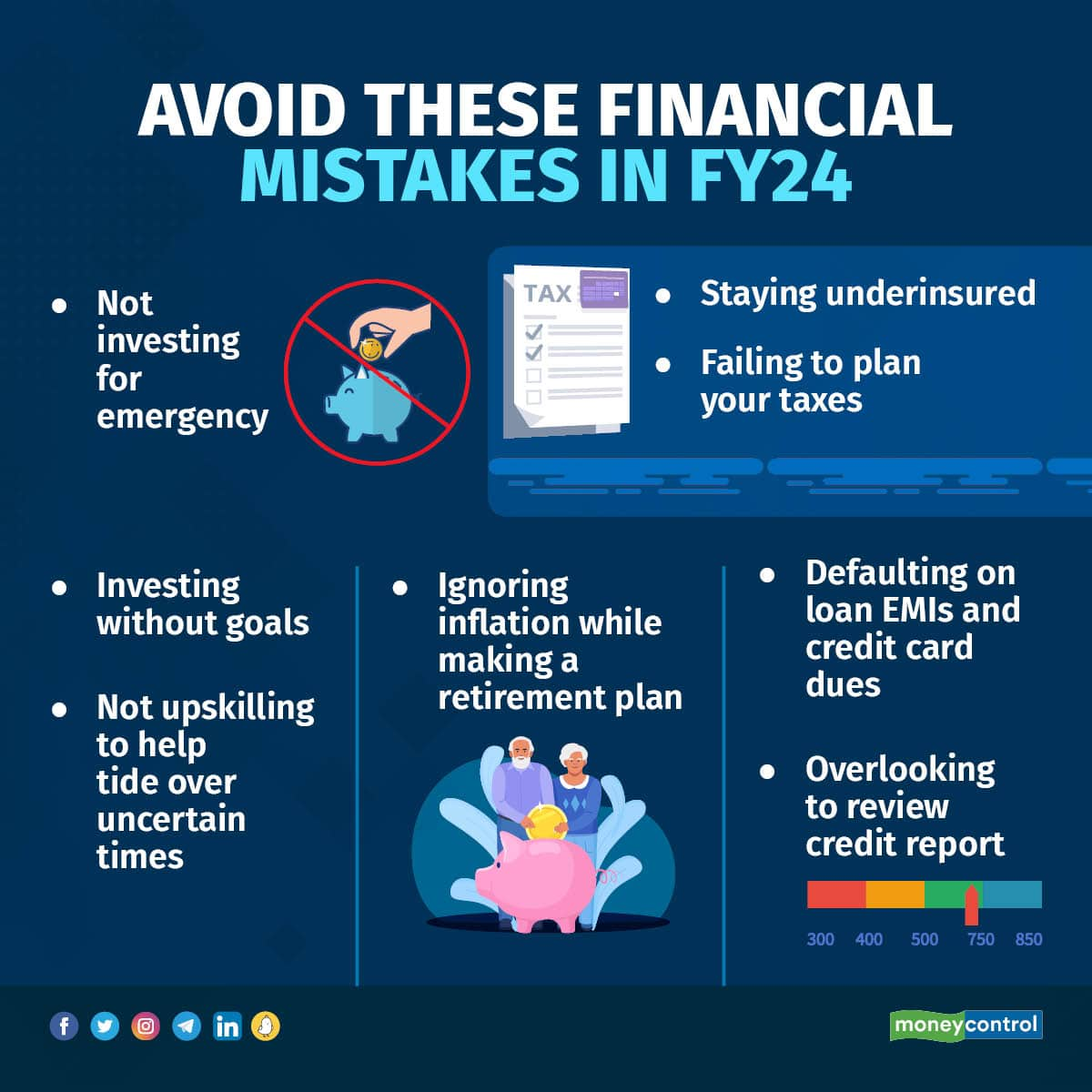

Image Source: moneycontrol.com

Investing can be a great way to grow your wealth, but it can also lead to money mishaps if you’re not careful. One common mistake is putting all your eggs in one basket. Diversification is key to reducing risk and protecting your investments from market fluctuations. Spread your investments across different asset classes, industries, and geographic regions to build a well-rounded portfolio that can weather any storm.

Another money mishap to avoid is falling victim to scams or fraud. With the rise of online shopping and digital transactions, scammers are constantly finding new ways to steal your money or personal information. Protect yourself by being cautious of unsolicited emails or phone calls, using secure payment methods, and keeping your personal information secure. If something seems too good to be true, it probably is.

Finally, one of the biggest money mishaps you can make is ignoring your financial health altogether. It’s easy to bury your head in the sand and hope for the best, but that won’t make your money problems disappear. Take control of your finances by creating a budget, tracking your expenses, paying off debt, and setting financial goals for the future. By staying proactive and informed, you can avoid common money mishaps and set yourself up for a secure financial future.

In conclusion, navigating common financial pitfalls doesn’t have to be daunting or overwhelming. By being mindful of your spending, saving for the future, diversifying your investments, protecting yourself from scams, and taking control of your financial health, you can steer clear of money mishaps and sail smoothly through any financial troubles that come your way. Remember, it’s never too late to start taking control of your finances and building a secure financial future for yourself.

Navigating Common Financial Pitfalls: A Casual Guide

When it comes to managing our finances, many of us find ourselves sailing through choppy waters at one point or another. Whether it’s unexpected expenses, mounting debt, or simply trying to make ends meet, financial troubles can often feel overwhelming. However, with a little bit of guidance and a positive attitude, you can navigate these common pitfalls with ease.

One of the key aspects of sailing smoothly through financial troubles is to stay organized. Keeping track of your income, expenses, and debts can help you get a clear picture of your financial situation and identify areas where you can make improvements. Creating a budget is a great way to start, as it allows you to see where your money is going and where you can cut back on unnecessary expenses.

Another important aspect of navigating financial troubles is to plan ahead for unexpected expenses. Setting up an emergency fund can provide you with a financial cushion in case of emergencies such as car repairs, medical bills, or job loss. By putting aside a small portion of your income each month, you can build up a savings fund that will give you peace of mind during tough times.

Additionally, it’s important to tackle your debts head-on in order to sail smoothly through financial troubles. High-interest debts such as credit card balances can quickly spiral out of control if left unchecked, so it’s important to come up with a plan to pay them off as soon as possible. Consider consolidating your debts or negotiating with creditors to lower your interest rates and make repayment more manageable.

In addition to staying organized, planning for emergencies, and tackling your debts, it’s also important to stay positive and maintain a healthy mindset when facing financial troubles. It’s easy to feel overwhelmed and discouraged when dealing with money issues, but by staying focused on your goals and taking small steps towards financial stability, you can overcome these challenges with ease.

Remember, everyone faces financial troubles at some point in their lives, and it’s important to approach these challenges with a sense of resilience and determination. By staying organized, planning for emergencies, tackling your debts, and maintaining a positive attitude, you can sail smoothly through financial troubles and come out on the other side stronger and more financially savvy than ever before.

So, the next time you find yourself facing financial troubles, remember to stay organized, plan ahead, tackle your debts, and stay positive. With a little bit of guidance and a proactive approach, you can navigate these common financial pitfalls with ease and set sail towards a brighter financial future.

How to Avoid Common Financial Pitfalls