Mastering Student Loans: A Guide to Borrowing Wisely

Student loans can be a daunting topic for many individuals, especially for those who are just beginning their journey into higher education. With the rising costs of tuition and living expenses, it’s important for students to be well-informed and savvy when it comes to borrowing money for their education. This guide will provide tips and tricks for navigating student loan borrowing with ease, ensuring that you can make the most out of your educational experience without being burdened by overwhelming debt.

First and foremost, it’s crucial to understand the different types of student loans available to you. There are federal student loans, which are funded by the government and typically offer lower interest rates and more flexible repayment options. On the other hand, private student loans are provided by banks, credit unions, and other financial institutions, and often come with higher interest rates and less favorable terms. By familiarizing yourself with the differences between these two types of loans, you can make an informed decision about which option is best for you.

When it comes to borrowing wisely, it’s important to only take out the amount of money that you truly need. While it may be tempting to borrow more than necessary to cover additional expenses, such as housing or transportation, doing so can lead to unnecessary debt that will be difficult to repay in the future. Before accepting a student loan offer, take the time to carefully calculate your expenses and determine the minimum amount of money required to cover your tuition and essential living costs.

Another key aspect of borrowing wisely is to explore all available options for financial aid before resorting to student loans. This includes scholarships, grants, work-study programs, and other forms of assistance that do not need to be repaid. By maximizing your non-loan financial aid opportunities, you can reduce the amount of money you need to borrow and lessen the financial burden you will face after graduation.

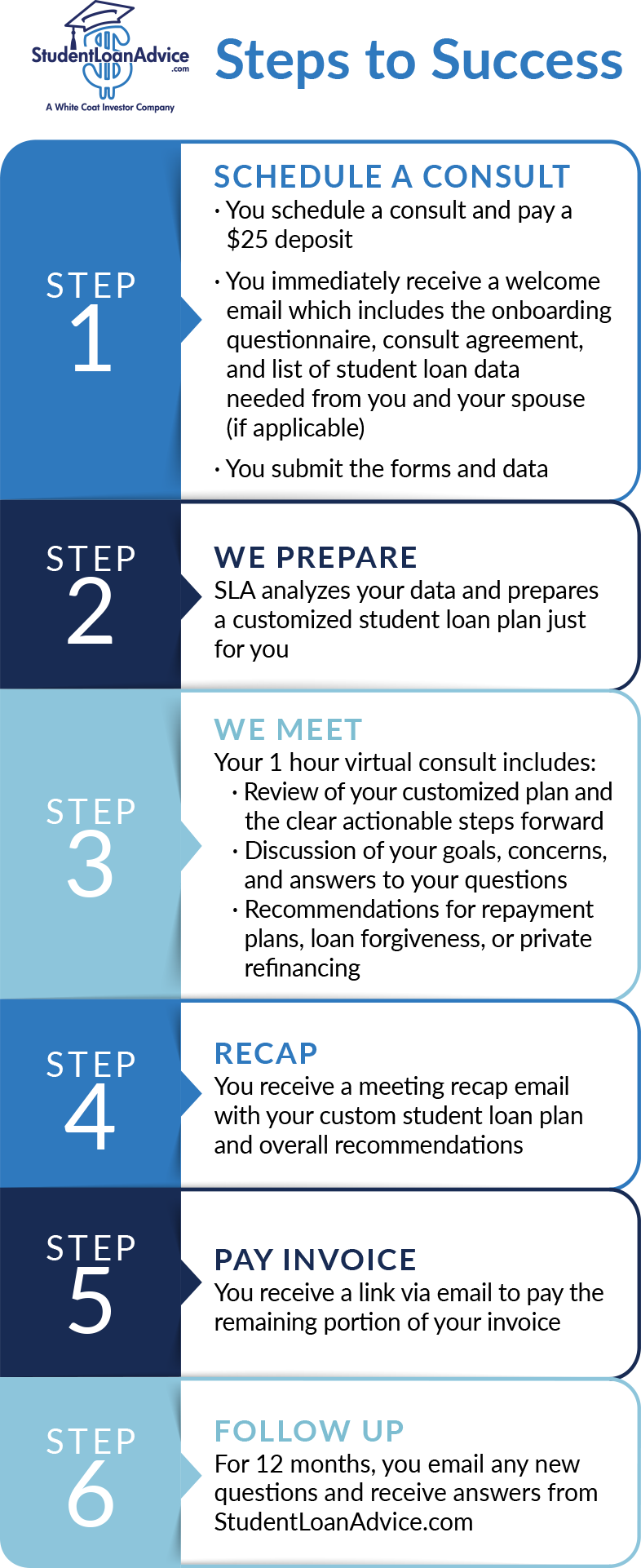

Image Source: studentloanadvice.com

Once you have decided to take out a student loan, it’s important to be proactive in managing your debt. This includes keeping track of your loan balance, interest rates, and repayment schedule to ensure that you stay on top of your payments and avoid falling behind. Additionally, consider making interest payments while you are still in school to prevent your loan balance from growing larger over time.

If you find yourself struggling to make your loan payments after graduation, don’t hesitate to reach out to your loan servicer for assistance. Many lenders offer income-driven repayment plans, loan consolidation options, and other programs designed to help borrowers manage their debt effectively. By taking advantage of these resources, you can avoid defaulting on your loans and damaging your credit score.

In conclusion, mastering student loans is all about understanding your options, borrowing responsibly, and managing your debt effectively. By following the tips and tricks outlined in this guide, you can navigate the world of student loan borrowing with ease and set yourself up for financial success in the future. Remember, education is an investment in yourself, so take the time to make smart decisions about how you finance your college experience.

Tips and Tricks for Navigating Student Loan Borrowing

Are you feeling overwhelmed by the prospect of taking out student loans to finance your education? Don’t worry – you’re not alone! Navigating the world of student loan borrowing can be tricky, but with the right tips and tricks, you can make the process much easier and more manageable. In this article, we’ll explore some creative strategies for maximizing your borrowing experience and ensuring that you make smart financial decisions when it comes to funding your education.

One of the first things to consider when it comes to student loan borrowing is understanding the different types of loans available to you. Federal student loans, which are offered by the government, typically come with lower interest rates and more flexible repayment options than private loans. By taking the time to research and compare the various loan options available to you, you can ensure that you’re getting the best possible terms for your borrowing needs.

Another important tip for navigating student loan borrowing is to create a budget and stick to it. Before taking out any loans, sit down and calculate exactly how much money you’ll need to cover your tuition, fees, and living expenses. By creating a detailed budget, you can avoid borrowing more money than you actually need and keep your debt burden to a minimum.

Additionally, it’s important to explore alternative funding sources before turning to student loans. Scholarships, grants, and work-study programs can all provide valuable financial assistance that doesn’t need to be repaid. By maximizing these resources, you can reduce the amount of money you need to borrow and set yourself up for a more financially secure future.

When it comes to actually applying for student loans, be sure to shop around and compare offers from multiple lenders. Interest rates, repayment terms, and fees can vary significantly between different loan providers, so it’s important to do your research and choose the loan that offers the best terms for your individual situation.

Once you’ve taken out a student loan, it’s crucial to stay organized and keep track of your borrowing. Make sure to keep all of your loan documents in a safe place, and create a repayment plan that works for your budget. By staying on top of your loans and making timely payments, you can avoid late fees and damaging your credit score.

Finally, don’t be afraid to ask for help if you’re struggling to make your loan payments. Many lenders offer loan deferment or forbearance options for borrowers facing financial hardship, so be sure to reach out to your loan servicer if you’re having trouble making ends meet. Additionally, consider working with a financial advisor or credit counselor to develop a plan for managing your student loan debt and achieving your long-term financial goals.

In conclusion, navigating student loan borrowing doesn’t have to be a daunting task. By following these tips and tricks, you can make smart financial decisions, minimize your debt burden, and set yourself up for a successful future. Remember to stay informed, stay organized, and don’t hesitate to ask for help when you need it. With a little creativity and a positive attitude, you can master the art of student loan borrowing with ease.

Navigating Student Loans: Tips for Borrowers