Tapping into the Perks of Credit Cards

Credit cards have become an essential tool in today’s world, offering a convenient and efficient way to make purchases, both in person and online. But beyond the obvious benefit of being able to buy now and pay later, credit cards come with a whole host of perks that make them even more appealing.

One of the biggest perks of using a credit card is the rewards programs that many cards offer. These programs allow cardholders to earn points or cash back on every purchase they make, which can then be redeemed for a variety of rewards such as airline miles, hotel stays, gift cards, and more. For frequent travelers or those who like to earn rewards on their everyday purchases, a credit card with a solid rewards program can be a great way to save money and get extra perks.

Another major perk of credit cards is the ability to build credit. Using a credit card responsibly by making payments on time and keeping balances low can help individuals establish and improve their credit score. A good credit score is essential for things like getting approved for loans, renting an apartment, and even getting a job, so using a credit card wisely can have long-term benefits.

Credit cards also offer additional consumer protections that can come in handy in certain situations. Many credit cards come with purchase protection, which can help cardholders get reimbursed if an item they purchased is damaged or stolen. Credit cards also offer fraud protection, so if someone steals your card information and makes unauthorized purchases, you are not held liable for those charges.

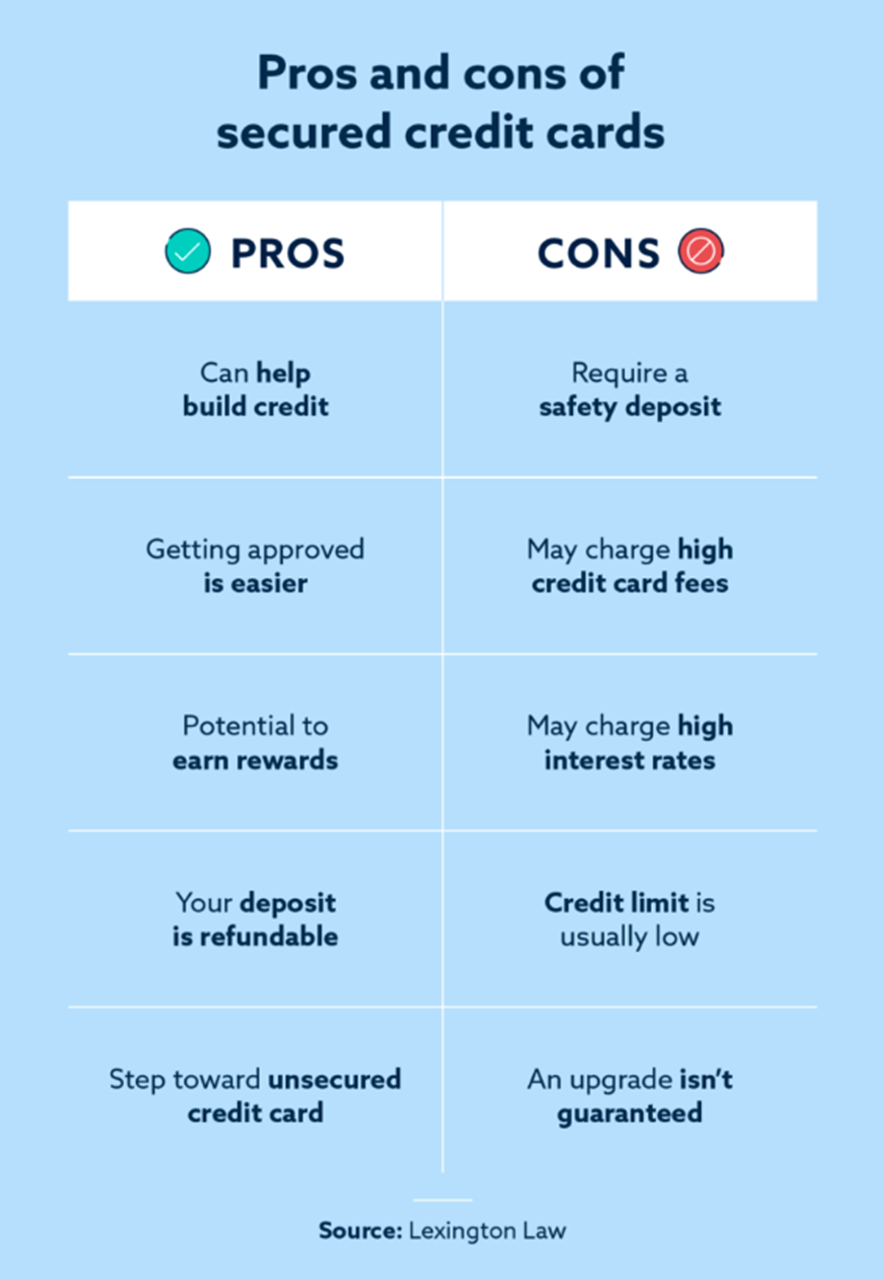

Image Source: lexingtonlaw.com

Beyond these practical benefits, credit cards also offer a level of convenience that cash simply cannot match. With a credit card, you don’t have to worry about carrying around large amounts of cash or running to the ATM every time you need to make a purchase. Credit cards are widely accepted at most retailers and can be used for online shopping, making them a versatile and convenient payment option.

However, despite the many perks of credit cards, there are also some drawbacks that should be considered. One of the biggest drawbacks of credit cards is the potential for overspending. It can be easy to lose track of how much you are charging to your card, especially when making small, everyday purchases. This can lead to carrying a balance from month to month and racking up high-interest charges, ultimately costing you more in the long run.

Credit cards also come with fees that can add up over time. Annual fees, late payment fees, and foreign transaction fees are just a few of the charges that cardholders may incur. It’s important to read the fine print and understand the fees associated with your credit card to avoid any surprises.

Another drawback of credit cards is the temptation to rely on them too heavily. It can be easy to fall into the trap of using a credit card to cover expenses when you don’t have enough money in your bank account. This can lead to a cycle of debt that can be difficult to break free from.

In conclusion, credit cards offer a wide range of perks that make them a valuable financial tool for many individuals. From rewards programs to consumer protections to convenience, there are plenty of reasons to consider using a credit card for your purchases. However, it’s important to be aware of the potential drawbacks as well, such as overspending, fees, and debt accumulation. By using a credit card responsibly and staying informed about the terms and conditions of your card, you can make the most of the benefits while minimizing the drawbacks.

Exploring the Pitfalls of Plastic Money

In today’s modern world, credit cards have become an essential part of our daily lives. They offer convenience, security, and rewards that cash simply cannot match. However, like any form of financial tool, credit cards also come with their own set of pitfalls that consumers need to be aware of.

One of the biggest drawbacks of credit cards is the temptation to overspend. With a credit card in hand, it can be easy to justify making purchases that you may not be able to afford with cash. This can lead to a cycle of debt that is difficult to break free from. Additionally, the convenience of credit cards can also make it easy to lose track of how much you are spending, leading to a shockingly high bill at the end of the month.

Another drawback of credit cards is the high interest rates that can quickly accumulate if you carry a balance from month to month. These interest rates can make even small purchases much more expensive in the long run, and can significantly impact your overall financial health. It is important for consumers to be aware of the interest rates on their credit cards and to pay off their balances in full each month to avoid accruing unnecessary debt.

Credit cards also come with fees that can add up quickly if you are not careful. Annual fees, late payment fees, and foreign transaction fees are just a few examples of the charges that credit card companies may impose on cardholders. These fees can eat into any rewards or cash back that you may be earning with your credit card, making it important to read the fine print and understand the terms and conditions of your card.

Security is another concern when it comes to credit cards. While credit cards offer protections against fraudulent charges, they can also be vulnerable to hacking and identity theft. It is important for consumers to monitor their credit card statements regularly and report any suspicious activity to their card issuer immediately. Additionally, using secure websites and not sharing your credit card information with anyone can help protect your financial information from falling into the wrong hands.

Despite these pitfalls, credit cards can still be a valuable financial tool when used responsibly. They offer convenience and security that cash simply cannot match, and can help consumers build credit history that is essential for making larger purchases such as a car or a home. By understanding the drawbacks of credit cards and taking steps to mitigate them, consumers can make the most of their plastic money while avoiding the pitfalls that can lead to financial trouble.

The Pros and Cons of Credit Cards